Digital Asset Regulations and Compliance in 2025

Digital Assets

Insights by Dr. Rahul Dev

Understand Practical Aspects

Understand the process of launching digital assets and tokens

Insights by Dr. Rahul Dev

Understand the process of launching digital assets and tokens

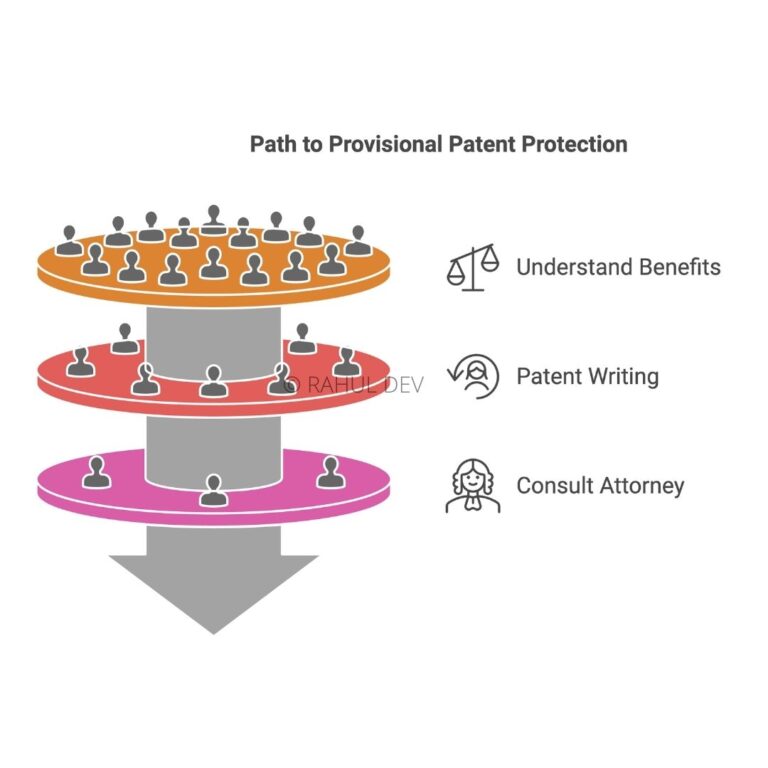

Protect your innovations across multiple countries and create strong patent portfolio to boost business valuation

Local and global brand protection through international trademark registrations

Extensive research and business writing for technical whitepapers and B2B content products

Here I discuss digital asset regulations and compliance in 2025 along with tokenization process to launch your own tokens. The global cryptocurrency landscape represents approximately $3 trillion in market capitalization, constituting 2.6% of world GDP, yet operates within a fragmented regulatory environment spanning 75+ jurisdictions with varying digital asset compliance 2025 requirements.

The current crypto regulation 2025 environment demonstrates significant variation across major jurisdictions, creating critical legal requirements for crypto whitepaper development and strategic positioning. The European Union’s Markets in Crypto-Assets Regulation (MiCAR) entered force June 2023 with transition periods extending until mid-2026, while the United States maintains enforcement-driven oversight through SEC and CFTC actions totaling over $6 billion in crypto-related penalties. Asian markets including Singapore, Japan, and Hong Kong have established comprehensive licensing regimes, whereas Middle Eastern jurisdictions like the UAE offer multiple regulatory pathways through ADGM crypto regulations, VARA licensing UAE, and DIFC digital asset rules authorities, all addressable through our MENA Market Entry and Licensing Strategy advisory services.

This article covers following topics:

Regulatory Requirements for Launching Digital Assets

Digital Asset Projects in European and MENA Markets

Emerging Technology Governance for Digital Asset Projects

Business Applications and Compliance of Digital Assets

Project Compliance Strategy for Launching Digital Assets

Utility Token Legal Opinion and Compliance Analysis provides comprehensive legal classification determination under securities laws across multiple jurisdictions, directly answering what is MiCAR compliance questions while addressing regulatory compliance assessment with formal legal opinion letters. This utility token legal opinion service targets ICO/ITO projects, DeFi protocols, and tokenization platforms requiring regulatory clarity, specifically addressing SEC, MiCAR, and global frameworks with utility classification defenses and compliance strategies developed through our established track record of successful token classifications. The analysis covers jurisdiction-specific requirements while maintaining defensible positions against securities characterization challenges, incorporating why regulatory clarity matters for crypto positioning throughout documentation.

Technical Whitepaper Development and Legal Review combines technical architecture documentation with legal compliance requirements, incorporating tokenomics legal review and regulatory disclosure standards addressing crypto whitepaper legal review best practices. The service addresses blockchain startups, established crypto projects launching new tokens, and traditional companies entering the crypto space through integration of ISO/TC 307 blockchain legal services standards and jurisdiction-specific disclosure requirements. Each whitepaper undergoes comprehensive legal review ensuring technical accuracy aligns with regulatory expectations while addressing crypto legal questions 2025 through proactive compliance documentation.

The smart Contract Legal Framework and Audit Coordination encompasses legal review of smart contract terms, automated compliance mechanisms, and coordination with technical security audits ensuring legal and technical soundness while addressing can smart contracts be legally binding concerns. Target clients include DeFi legal compliance protocols, automated trading platforms, and blockchain-based financial services requiring regulatory compliance for automated financial services and consumer protection standards. The framework addresses regulatory requirements while maintaining functional smart contract operations through our Smart Contract Legal Framework and Audit Coordination methodology.

MiCAR Compliance Transition and Implementation Support provides specialized guidance for EU crypto license transition under Markets in Crypto-Assets Regulation, including license application preparation, technical standards compliance, and transition planning for the June 2026 deadline addressing MiCAR implementation timeline requirements. Target clients include crypto service providers seeking EU market access and existing operators requiring EU VASP license MiCAR transition, addressing the critical compliance gap affecting 75% of EU VASPs at risk of license lapse. The service addresses technical standards implementation while managing transition timeline requirements through our established relationships with European regulatory authorities.

The MENA Market Entry and Licensing Strategy offers comprehensive advisory for Middle East expansion, covering UAE multi-authority framework navigation including VARA licensing UAE, ADGM crypto regulations, and DIFC digital asset rules, while addressing how to get a crypto license in UAE procedural requirements. The service addresses international crypto companies expanding to the MENA region and regional startups seeking optimal licensing strategies through established relationships with UAE sandbox programs and CBB regulatory processes. Strategic positioning leverages regulatory-friendly jurisdictions for regional market access while ensuring is tokenization legal in UAE compliance verification.

Also, the global Stablecoin Regulatory Compliance and Reserve Management provides end-to-end stablecoin legal framework compliance covering reserve requirements, audit protocols, and multi-jurisdictional licensing across US proposed frameworks, MiCAR requirements, and Asian stablecoin regulations addressing is stablecoin legal in Europe determinations. Target clients include stablecoin issuers, payment platforms, and institutional treasury services addressing the 99% USD-pegged stablecoin market with focus on regulatory arbitrage crypto and compliance optimization. Reserve management protocols ensure regulatory compliance across multiple jurisdictions through systematic audit and reporting frameworks.

The AML/KYC Program Development and FATF Travel Rule Implementation encompasses comprehensive anti-money laundering program design including FATF travel rule crypto compliance, transaction monitoring systems, and regulatory reporting frameworks addressing how to comply with FATF travel rule requirements. The service addresses crypto exchanges, custodial services, and cross-border payment providers operating within the $86 million AML penalty landscape through prevention-focused compliance architecture. Implementation includes automated monitoring systems and regulatory reporting mechanisms ensuring comprehensive global crypto compliance standards.

In use, the Crypto Banking Relationship Facilitation and Due Diligence provides strategic advisory for establishing banking relationships, including crypto-friendly banking 2025 identification, due diligence preparation, and alternative financial infrastructure assessment addressing banking access challenges. Target clients include crypto startups facing banking access challenges and established firms seeking institutional banking partnerships through knowledge of crypto-dedicated banking windows in favorable jurisdictions. Due diligence preparation addresses banking compliance requirements specific to crypto operations while leveraging established banking industry relationships.

The DeFi Protocol Legal Architecture and DAO Governance Framework offers specialized legal structuring for decentralized finance protocols including DAO governance mechanisms, legal entity optimization, and regulatory compliance strategies for decentralized operations addressing which countries support DeFi regulation considerations. The service addresses DeFi legal compliance development teams, protocol treasuries, and decentralized autonomous organizations facing emerging regulatory challenges in decentralized governance and automated financial services. Legal architecture maintains operational flexibility while ensuring regulatory compliance through innovative governance structures.

Also, the Real-World Asset Tokenization Legal Framework provides comprehensive legal infrastructure for real-world asset tokenization law including securities law compliance, custody arrangements, and cross-border transfer mechanisms addressing emerging regulatory frameworks. Target clients include real estate tokenization platforms, commodity trading firms, and institutional asset managers entering crypto space through emerging regulatory frameworks including Qatar’s token service provider regime. The framework addresses asset custody and transfer mechanisms while maintaining regulatory compliance across multiple jurisdictions.

The Crypto Enforcement Defense and Regulatory Investigation Response offers specialized crypto enforcement defense services for regulatory investigations, enforcement actions, and compliance violations including SEC enforcement response, cross-border regulatory coordination, and penalty mitigation strategies. The service addresses crypto companies facing regulatory scrutiny, exchanges under investigation, and projects requiring enforcement defense within the $6 billion SEC enforcement landscape and global regulatory coordination requirements. Defense strategies incorporate cross-jurisdictional regulatory coordination while leveraging extensive experience with major enforcement proceedings.

The NFT and Digital Content Legal Protection Strategy provides comprehensive NFT legal protection 2025 framework including intellectual property protection, creator rights management, and platform compliance across global jurisdictions addressing do NFTs need legal protection requirements. Target clients include NFT marketplaces, digital content creators, and entertainment industry blockchain projects addressing emerging IP law developments and platform liability frameworks. Protection strategies address creator rights and platform compliance requirements while ensuring comprehensive intellectual property safeguards.

Crypto Tax Optimization and Multi-Jurisdictional Planning encompasses advanced crypto tax optimization strategies for crypto operations including jurisdiction optimization, transfer pricing for digital assets, and regulatory arbitrage within tax compliance frameworks addressing what is crypto tax arbitrage opportunities. The service addresses institutional crypto investors, mining operations, and high-volume trading entities through knowledge of varying global crypto tax treatments and optimization opportunities. Planning strategies maintain tax compliance while optimizing jurisdictional advantages through systematic tax planning methodologies.

CBDC Impact Assessment and Private Crypto Positioning provides strategic advisory for positioning private crypto projects in CBDC-enabled economies including competitive analysis, regulatory compliance adjustment, and business model optimization addressing CBDC vs private crypto competitive dynamics. Target clients include payment platforms, stablecoin projects, and financial service providers addressing competitive landscape considerations as 68% of central banks research CBDCs. Strategic positioning addresses market differentiation within CBDC competition while maintaining regulatory compliance standards.

The evolving crypto regulation 2025 landscape demands specialized legal expertise addressing multi-jurisdictional requirements while maintaining operational flexibility for digital asset companies seeking best countries for crypto startups opportunities. Comprehensive crypto legal services provide systematic solutions spanning foundational compliance, advanced advisory, specialized consulting, and strategic business applications addressing the complete spectrum of regulatory requirements through our integrated service portfolio. Professional legal guidance ensures regulatory compliance while optimizing business opportunities within the expanding digital asset compliance 2025 ecosystem.

A proactive compliance strategies demonstrate significant crypto compliance ROI through avoided penalties, secured licensing, and enhanced business opportunities utilizing comprehensive blockchain legal services expertise. Strategic positioning within high-clarity regulatory jurisdictions provides competitive advantages while comprehensive service portfolios address evolving cross-border crypto regulations requirements across global markets. Early compliance adoption creates sustainable competitive advantages within the rapidly evolving crypto regulatory environment through systematic compliance planning.

As a business coach and thought leader, I cannot emphasize enough the importance of innovation, new software patents, mobile apps, and patents for tech companies, startups, and entrepreneurs. The world is rapidly evolving, and staying ahead of the curve is vital for success. Embracing technological advancements such as blockchain and AI can unlock unprecedented opportunities, streamline operations, and propel businesses into the future with competitive valuation via intangible assets.

Click Here for AI Startup Valuation Guide.

For instance, blockchain technology can revolutionize supply chain management and secure data sharing wherein innovative business models are explained to the audience via technical whitepapers, while AI can automate and optimize decision-making processes. Mobile apps are no longer just a luxury; they have become essential tools for engaging customers and offering personalized experiences. Furthermore, securing digital innovation patents is crucial for protecting intellectual property, fostering innovation, and maintaining a competitive edge. By investing in these areas, businesses can position themselves as industry pioneers and pave the way for a prosperous future after thoroughly conducting the due diligence and reviewing the legal opinion letters, which in case of digital assets can assist in determining the tokens as utility assets or coins as utility tokens before listing the assets at an exchange.

Our team of advanced patent attorneys assists clients with patent searches, drafting patent applications, and patent (intellectual property) agreements, including licensing and non-disclosure agreements. Advocate Rahul Dev is a Patent Attorney & International Business Lawyer practicing Technology, Intellectual Property & Corporate Laws. He is reachable at rd (at) patentbusinesslawyer (dot) com & @rdpatentlawyer on Twitter.

Quoted in and contributed to 50+ national & international publications (Bloomberg, FirstPost, SwissInfo, Outlook Money, Yahoo News, Times of India, Economic Times, Business Standard, Quartz, Global Legal Post, International Bar Association, LawAsia, BioSpectrum Asia, Digital News Asia, e27, Leaders Speak, Entrepreneur India, VCCircle, AutoTech).

Regularly invited to speak at international & national platforms (conferences, TV channels, seminars, corporate trainings, government workshops) on technology, patents, business strategy, legal developments, leadership & management.

Working closely with patent attorneys along with international law firms with significant experience with lawyers in Asia Pacific providing services to clients in US and Europe. Flagship services include international patent and trademark filings, patent services in India and global patent consulting services.

Global Blockchain Lawyers (www.GlobalBlockchainLawyers.com) is a digital platform to discuss legal issues, latest technology and legal developments, and applicable laws in the dynamic field of Digital Currency, Blockchain, Bitcoin, Cryptocurrency and raising capital through the sale of tokens or coins (ICO or Initial Coin Offerings).

Blockchain ecosystem in India is evolving at a rapid pace and a proactive legal approach is required by blockchain lawyers in India to understand the complex nature of applicable laws and regulations.