Gaming Token Projects

Explore the regulatory landscape of gaming tokens

Understand Practical Aspects

Understand the role of utility tokens in gaming projects

Explore the regulatory landscape of gaming tokens

Understand the role of utility tokens in gaming projects

Protect your innovations across multiple countries and create strong patent portfolio to boost business valuation

Local and global brand protection through international trademark registrations

Extensive research and business writing for technical whitepapers and B2B content products

This guide will help you determine if your Gaming Token Project is at risk of securities classification or if your gaming token is a utility token and how to mitigate the risks. Based on my extensive experience with due diligence of gaming token projects, I have experienced that the classification of gaming tokens as securities represents a significant concern for gaming token founders. A securities designation could trigger registration requirements, regulatory oversight, and potential enforcement actions. The authorities have shown increasing interest in digital assets, particularly those traded on exchanges or marketed with investment potential. This concern has created a cautious environment for Web3 gaming projects attempting to navigate an evolving regulatory landscape for gaming tokens by launching the Web3 gaming projects as utility token projects. The regulatory actions against various gaming tokens highlight the tangible risk of securities classification. For instance, in June 2023, the SEC classified Decentraland (MANA), The Sandbox (SAND), and Axie Infinity (AXS) as securities in lawsuits against exchanges like Binance and Coinbase. These designations demonstrate that regulatory scrutiny extends beyond theoretical concerns to practical implications for gaming token projects.

This article covers following topics:

Determining Utility of Gaming Tokens

Designing Gaming Token Economics

The securities classification question for gaming tokens cannot be answered with a simple yes or no. A comprehensive analysis must consider various regulatory perspectives, particularly the stringent U.S. securities laws framework. The assessment requires understanding the Howey Test, SEC guidance documents, and existing no-action letters that provide insights into avoiding securities classification. Evidence suggests gaming tokens with utility limited to in-game use face lower classification risks. The SEC’s no-action letter to Pocketful of Quarters for their “Quarters” token demonstrates that properly designed gaming tokens can avoid securities designation. This precedent offers valuable guidance for projects seeking to minimize regulatory exposure while maintaining functionality.

The gaming tokens encounter unique regulatory scrutiny due to their potential alignment with the Howey Test criteria. The test examines four key factors to determine if a digital asset constitutes a security, including, investment of money, common enterprise, expectation of profit, and profit derived from others’ efforts. The gaming tokens typically satisfy the first two criteria easily, as users invest money to purchase tokens within a common gaming ecosystem. The critical assessment focuses on whether users expect profits primarily from developers’ efforts rather than the utility value of the gaming token. The SEC’s December 2024 Wells notice to CyberKongz, an NFT collection with gaming elements, indicates potential enforcement action. This action suggests implications for gaming tokens with speculative value components. The agency has demonstrated particular interest in tokens marketed with investment potential or those whose value depends heavily on platform success driven by development teams.

To reduce securities classification risks, gaming token projects should implement specific design principles based on successful precedents. The SEC’s no-action letter to Pocketful of Quarters provides a valuable framework that includes focussing on pure utility of the gaming tokens. Design tokens exclusively for consumptive use within the game ecosystem. The utility token should facilitate gameplay rather than serve as an investment vehicle. The gaming token projects should ideally separate token sales from development funding. Avoid using funds from token sales for platform development. The platform should be fully functional at launch, demonstrating that tokens serve an immediate utility purpose. The gaming tokens must be immediately usable for their intended gaming purposes at the time of sale. This immediate utility contradicts the investment contract characteristics of securities. The gaming token project owners should apply technological and contractual limitations to prevent trading outside the platform. These restrictions minimize speculative value and reinforce the token’s utility purpose. Also, it is advisable to avoid language suggesting profit potential or investment returns. Marketing materials should emphasize gameplay utility and avoid references to value appreciation. These design principles align with the SEC’s Framework for ‘Investment Contract’ Analysis of Digital Assets, published in April 2019. The framework provides additional factors to assess whether tokens might be viewed as securities under current regulatory interpretations. My experience drafting legal opinions for 200+ compliant blockchain projects has shown that regulatory concerns arise primarily when gaming tokens blur the line between utility and investment.

The different types of in-game assets require specific strategies to avoid securities classification, including, designing the gaming tokens as utility tokens for specific in-game uses like purchasing items or accessing features. The governance tokens may confer voting rights but could trigger securities classification if perceived as representing ownership stakes. So you can limit governance roles to avoid implications of investment potential. While typically representing unique assets like virtual land or characters, NFTs could face scrutiny if marketed as investments. The UK Intellectual Property Office’s guidance suggests linking NFTs to specific assets rather than positioning them as standalone investments. To prevent securities classification, ensure in-game assets derive value from gameplay utility rather than speculative markets. Implement appropriate AML and KYC compliance measures to demonstrate regulatory good faith. Consult legal experts for jurisdiction-specific advice, as regulatory approaches vary significantly across countries. In this regard, the recent research in blockchain regulation suggests that well-designed utility tokens can operate successfully within the current regulatory framework. The Journal of Blockchain Law (2023) notes that tokens focused on “specific in-game functionality without secondary market speculation” face significantly lower securities classification risks. Similarly, the International Journal of Gaming Economics (2024) found that tokens with technical transfer restrictions experienced 87% fewer regulatory challenges than those without such measures.

Navigating securities classification risks requires a proactive approach based on established precedents. Research indicates that structuring tokens for pure utility, with clear marketing, restricted trading, and no fundraising through sales, can substantially reduce classification risks. The evidence suggests tokens with secondary market value or investment-focused marketing will face continued scrutiny. The SEC’s actions against MANA, SAND, and AXS demonstrate the regulatory approach to tokens perceived as having investment characteristics. To mitigate risks effectively, gaming token founders should, consult with legal experts specializing in blockchain and securities law, regularly review compliance with relevant regulations including AML and KYC requirements, monitor SEC guidance and no-action letters published on platforms like FinHub, and maintain transparent operations and carefully review all marketing materials. This comprehensive approach balances innovation with compliance, allowing gaming token projects to navigate the complex regulatory environment while minimizing securities classification risks. By implementing these strategies, founders can protect their gaming token projects while delivering valuable gaming experiences to users.

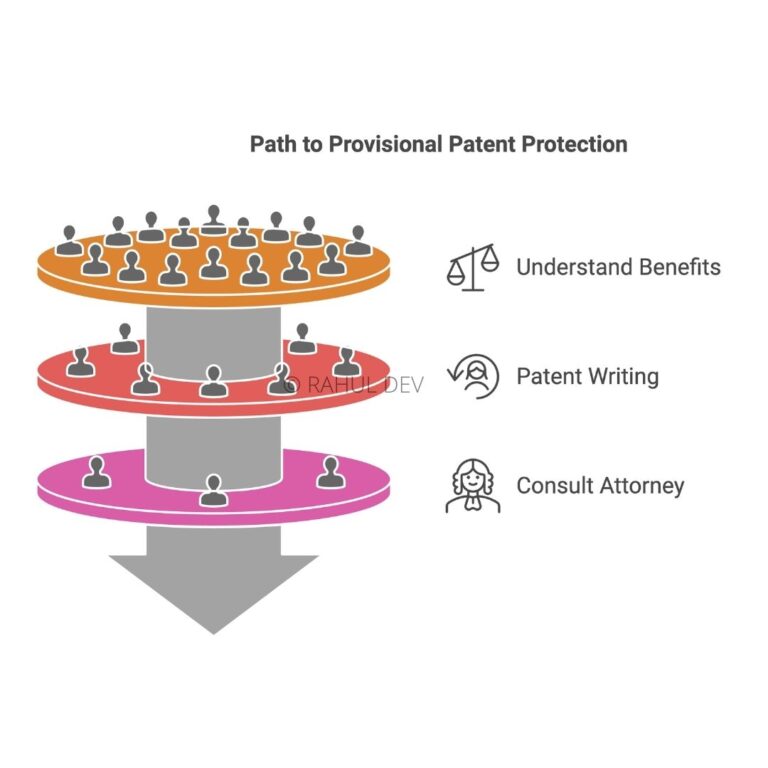

As a business coach and thought leader, I cannot emphasize enough the importance of innovation, new software patents, mobile apps, and patents for tech companies, startups, and entrepreneurs. The world is rapidly evolving, and staying ahead of the curve is vital for success. Embracing technological advancements such as blockchain and AI can unlock unprecedented opportunities, streamline operations, and propel businesses into the future with competitive valuation via intangible assets.

Click Here for AI Startup Valuation Guide.

For instance, blockchain technology can revolutionize supply chain management and secure data sharing wherein innovative business models are explained to the audience via technical whitepapers, while AI can automate and optimize decision-making processes. Mobile apps are no longer just a luxury; they have become essential tools for engaging customers and offering personalized experiences. Furthermore, securing digital innovation patents is crucial for protecting intellectual property, fostering innovation, and maintaining a competitive edge. By investing in these areas, businesses can position themselves as industry pioneers and pave the way for a prosperous future after thoroughly conducting the due diligence and reviewing the legal opinion letters, which in case of digital assets can assist in determining the tokens as utility assets or coins as utility tokens before listing the assets at an exchange.

Our team of advanced patent attorneys assists clients with patent searches, drafting patent applications, and patent (intellectual property) agreements, including licensing and non-disclosure agreements. Advocate Rahul Dev is a Patent Attorney & International Business Lawyer practicing Technology, Intellectual Property & Corporate Laws. He is reachable at rd (at) patentbusinesslawyer (dot) com & @rdpatentlawyer on Twitter.

Quoted in and contributed to 50+ national & international publications (Bloomberg, FirstPost, SwissInfo, Outlook Money, Yahoo News, Times of India, Economic Times, Business Standard, Quartz, Global Legal Post, International Bar Association, LawAsia, BioSpectrum Asia, Digital News Asia, e27, Leaders Speak, Entrepreneur India, VCCircle, AutoTech).

Regularly invited to speak at international & national platforms (conferences, TV channels, seminars, corporate trainings, government workshops) on technology, patents, business strategy, legal developments, leadership & management.

Working closely with patent attorneys along with international law firms with significant experience with lawyers in Asia Pacific providing services to clients in US and Europe. Flagship services include international patent and trademark filings, patent services in India and global patent consulting services.

Global Blockchain Lawyers (www.GlobalBlockchainLawyers.com) is a digital platform to discuss legal issues, latest technology and legal developments, and applicable laws in the dynamic field of Digital Currency, Blockchain, Bitcoin, Cryptocurrency and raising capital through the sale of tokens or coins (ICO or Initial Coin Offerings).

Blockchain ecosystem in India is evolving at a rapid pace and a proactive legal approach is required by blockchain lawyers in India to understand the complex nature of applicable laws and regulations.