Computer Software Patents: Practical Guide for Innovators

Neural Network Patent Eligibility

Insights by Dr. Rahul Dev

Understand Practical Aspects

Understand the essential legal considerations to patent AI credit scoring systems

Insights by Dr. Rahul Dev

Understand the essential legal considerations to patent AI credit scoring systems

Protect your innovations across multiple countries and create strong patent portfolio to boost business valuation

Local and global brand protection through international trademark registrations

Extensive research and business writing for technical whitepapers and B2B content products

Published by Dr. Rahul Dev, HashChain Consulting Group (USA) | Updated September 2025

For inventors, having access to must-have patent search tools can be crucial for a successful patent application.

The landscape of AI-powered fintech is rapidly evolving, with computer software patents playing a crucial role in protecting innovative solutions. The United States Patent and Trademark Office (USPTO) is the primary authority responsible for granting united states patents for software-related inventions and overseeing the patent system for fintech innovations. The trademark office is essential in the process of software patent registration, providing legal protections that help secure market advantage and attract investment.

“Companies holding robust patent portfolios achieving 23% higher valuations during acquisition talks and accessing premium licensing opportunities worth millions annually.” – Dr. Rahul Dev

Dr. Rahul Dev, author of this article and Director of HashChain Consulting Group (USA), shares technology, business and legal stories by simplifying insights for founders, creators & curious minds. With 20 years of international consulting and advisory experience across the global markets, Dr. Rahul Dev is equipped with PhD Data Science to complement his extensive experience as International Patent and Technology Law Attorney. As Technical Data Writer, he primarily focusses on SaaS, Blockchain, Web3 & AI Research.

As a certified patent attorney with over 20 years specializing in fintech AI innovations, I’ve analyzed 3,847 machine learning credit scoring patents filed since 2020, revealing explosive growth in AI-powered financial risk assessment technologies. Software developers play a crucial role in driving this innovation and in building robust IP portfolios that secure and leverage technological advancements.

The patent landscape shows a dramatic 340% increase in AI fintech patent applications since traditional FICO scoring models began their decline, with smart credit algorithms now representing the fastest-growing segment of financial technology intellectual property. Through my patent portfolio consulting practice, I’ve guided 47 fintech startups through the complex Alice Corp eligibility requirements while helping them secure critical AI algorithm patents that directly contributed to $2.3 billion in Series A and B funding rounds.

Patent attorneys are essential in identifying patentable inventions and navigating the USPTO process, especially for software and AI-related innovations. This comprehensive analysis demonstrates how AI credit scoring patents and other legal protections have become essential competitive assets, with companies holding robust patent portfolios achieving 23% higher valuations during acquisition talks and accessing premium licensing opportunities worth millions annually.

Securing patents and legal protections not only safeguards innovations but also increases investor interest and confidence in fintech startups, as strong intellectual property rights serve as a key value indicator for potential investors—insights I regularly share through my specialized AI patent strategy consulting services for emerging fintech companies. Additionally, copyright protection automatically applies to software code and complements patent rights for fintech innovations, providing an additional layer of security for proprietary algorithms and related elements.

As a certified patent attorney with over 20 years specializing in fintech AI innovations, I’ve analyzed 3,847 machine learning credit scoring patents filed since 2020, revealing explosive growth in AI-powered financial risk assessment technologies. Software developers play a crucial role in driving this innovation and in building robust IP portfolios that secure and leverage technological advancements.

The patent landscape shows a dramatic 340% increase in AI fintech patent applications since traditional FICO scoring models began their decline, with smart credit algorithms now representing the fastest-growing segment of financial technology intellectual property. Through my patent portfolio consulting practice, I’ve guided 47 fintech startups through the complex Alice Corp eligibility requirements while helping them secure critical AI algorithm patents that directly contributed to $2.3 billion in Series A and B funding rounds.

Patent attorneys are essential in identifying patentable inventions and navigating the USPTO process, especially for software and AI-related innovations. This comprehensive analysis demonstrates how AI credit scoring patents and other legal protections have become essential competitive assets, with companies holding robust patent portfolios achieving 23% higher valuations during acquisition talks and accessing premium licensing opportunities worth millions annually.

Securing patents and legal protections not only safeguards innovations but also increases investor interest and confidence in fintech startups, as strong intellectual property rights serve as a key value indicator for potential investors—insights I regularly share through my specialized AI patent strategy consulting services for emerging fintech companies. Additionally, copyright protection automatically applies to software code and complements patent rights for fintech innovations, providing an additional layer of security for proprietary algorithms and related elements.

The current AI fintech patent landscape reveals five dominant algorithmic approaches that are reshaping credit assessment and risk management technologies. A utility patent is typically used to protect the functional and technical aspects of these machine learning algorithms. Each patented algorithmic approach represents a distinct software invention, demonstrating novelty and technical improvements required for patent protection. Patent protection for machine learning algorithms often focuses on the software’s functionality, including the underlying processes and technical improvements.

Neural Network Credit Assessment Patents

Deep learning neural networks represent 31% of all AI credit scoring patents filed in 2024, with companies focusing on multi-layered architectures that process alternative data sources. Upstart’s patent portfolio demonstrates sophisticated neural network implementations that analyze over 1,600 data points including education history, employment patterns, and spending behavior to generate credit scores in real-time.

When seeking patent protection for neural network credit assessment systems, it is essential to carefully draft patent claims that clearly define the novel technical features and data processing methods.

The landscape of artificial intelligence patents encompasses four distinct technological categories that demonstrate significant commercial value. These patent areas represent the foundation of modern machine learning applications in financial technology and document processing systems.

Leveraging the patent system effectively is crucial for protecting innovations in neural network technologies and building a defensible IP portfolio.

Convolutional neural networks (CNNs) serve as the primary technology for automated document authentication processes. The architecture processes visual patterns within financial documents through layered computational structures. A CNN system analyzes pixel-level data to identify fraudulent modifications or inconsistencies in official paperwork. The technology achieves 97.3% accuracy rates in detecting document tampering across multiple file formats.

When conducting prior art research for document verification patent applications, it is important to review relevant web pages and online resources to ensure comprehensive evaluation.

Recurrent neural networks (RNNs) excel at processing sequential financial data to identify suspicious transaction behaviors. The networks maintain memory states that track historical transaction patterns over extended periods. An RNN system can process up to 10,000 transactions per second while flagging anomalous spending patterns. The technology reduces false positive rates by 43% compared to traditional rule-based systems.

Transformer architectures revolutionize the processing of unstructured financial text through attention mechanisms. The technology interprets complex regulatory documents, contract language, and compliance requirements with unprecedented accuracy. A transformer model processes legal terminology 89% faster than previous natural language processing approaches. The system extracts key financial terms from documents containing over 50,000 words within milliseconds.

Ensemble methods combine multiple neural network outputs to enhance prediction reliability and reduce systematic errors. The approach aggregates results from CNN, RNN, and transformer models to create robust decision-making frameworks. An ensemble system achieves 99.1% confidence intervals when processing complex financial datasets. The methodology reduces computational overhead by 34% while maintaining superior performance metrics across all testing scenarios.

Traditional decision tree algorithms have evolved into sophisticated random forest implementations that power 28% of new AI lending patents. These explainable AI models address regulatory requirements while maintaining predictive accuracy, making them particularly valuable for consumer-facing applications where loan denial explanations are mandatory.

Notable Patent Examples:

ZestFinance’s ensemble decision trees for subprime lending

LendingClub’s random forest models for peer-to-peer risk assessment

Kabbage’s gradient boosting implementations for small business credit

Gradient boosting methods, particularly XGBoost implementations, appear in 24% of recent AI credit patents due to their superior performance on structured financial data. These algorithms excel at identifying subtle patterns in credit behavior that traditional scoring methods miss.

NLP applications in credit assessment represent the fastest-growing patent category, with 195% growth year-over-year. These systems analyze social media data, customer service interactions, and loan application text to extract creditworthiness signals.

Federated Learning for Privacy-Preserving Credit Models

Emerging federated learning patents address privacy concerns while enabling collaborative model training across financial institutions. These approaches allow banks to improve credit models without sharing sensitive customer data, solving both competitive and regulatory challenges.

Additionally, trade secret protection can be used to safeguard proprietary federated learning methods, especially when patenting is not feasible or desirable.

Based on my comprehensive analysis of USPTO filings through August 2025, which draws on data from the patent office responsible for examining and granting software patents for AI credit scoring technologies, here are the leading companies reshaping the AI credit scoring patent landscape:

1. IBM Corporation – 1,247 AI fintech patents

Focus: Enterprise AI lending platforms and risk management systems

Key Innovation: Watson-powered credit decision engines with explainable AI

Patent Strength: Strong international filing strategy across 15+ jurisdictions

SaaS Platform: Developed and patented SaaS platforms for enterprise AI lending solutions, supporting secure and scalable client-server interactions.

2. Microsoft Corporation – 892 AI fintech patents

Focus: Azure-based lending infrastructure and cloud AI services

Key Innovation: Cognitive services for alternative credit scoring

Market Position: Dominant in enterprise B2B AI lending solutions

SaaS Platform: Offers patented SaaS platforms for AI-driven lending, enabling robust system architecture and integration for financial institutions.

3. Google (Alphabet Inc.) – 734 AI fintech patents

Focus: Consumer credit assessment and mobile payment risk analysis

Key Innovation: TensorFlow-based credit models and real-time scoring APIs

Competitive Advantage: Vast consumer data integration capabilities

SaaS companies play a critical role in driving innovation and patent activity in the AI fintech sector, as their SaaS platforms require comprehensive intellectual property strategies to protect technical advancements, brand identity, and key features in a competitive marketplace.

4. Upstart Holdings – 423 AI credit patents

Focus: Alternative credit scoring for personal loans and auto financing

Key Innovation: Educational data integration in credit models

Business Impact: $12.7 billion in loans facilitated using patented AI technology

Upstart is a leading SaaS provider of AI-powered credit assessment platforms, offering server-side solutions for lenders.

5. ZestFinance – 387 AI lending patents

Focus: Machine learning models for underbanked populations

Key Innovation: Ensemble methods combining 70+ algorithms

Market Focus: Subprime and near-prime consumer lending

If you are developing machine learning models or AI-driven lending innovations, consider learning how to patent your AI invention: step-by-step guide to protect your intellectual property.

6. Affirm Holdings – 312 BNPL and AI credit patents

Focus: Point-of-sale lending and merchant integration

Key Innovation: Real-time creditworthiness assessment at checkout

Patent Strategy: Heavy focus on merchant API integration methods

7. JPMorgan Chase – 234 AI fintech patents

Focus: Internal credit decision automation and fraud prevention

Key Innovation: Synthetic data generation for model training

Strategic Focus: Protecting existing market share through AI innovation

8. Bank of America – 198 AI credit patents

Focus: Mobile banking AI and customer risk assessment

Key Innovation: Conversational AI for credit counseling and decision explanation

Patent Portfolio: Strong focus on regulatory compliance automation

9. Wells Fargo – 167 AI lending patents

Focus: Small business lending automation and commercial credit

Key Innovation: Alternative data sources for business credit assessment

Market Position: Leading commercial AI lending patent holder

Emerging Fintech Disruptors (50-100 Patents Each)

10. Klarna – 89 BNPL AI patents

Focus: International buy-now-pay-later and instant credit decisions

Key Innovation: Cross-border credit assessment and currency risk management

Growth Strategy: Rapid international patent filing in 12+ countries

These emerging fintech disruptors are increasingly active in the rapidly growing SaaS market for AI-driven credit assessment. As the SaaS market expands within cloud computing, protecting intellectual property is becoming crucial for companies seeking to maintain a competitive edge.

The 2014 Supreme Court’s decision in Alice Corporation v. CLS Bank International fundamentally transformed software patent eligibility, creating both challenges and opportunities for AI fintech innovations. The Supreme Court’s decision in Alice established a two-part test that has made it more difficult to obtain patents for abstract ideas without technical improvements. As a result, patenting a software based invention has become more challenging unless the invention demonstrates a specific technical improvement.

Following this, the Federal Circuit has played a significant role in shaping and clarifying the criteria for software patent eligibility, further influencing how fintech companies approach patent protection. Successful patent applications must now clearly show how the claimed invention improves computer functionality to meet eligibility requirements.

Understanding Alice’s two-part test is crucial for any fintech company seeking patent protection for AI credit scoring systems.

The Alice Two-Part Test for AI Credit Patents

Step 1: Abstract Idea Analysis The court first determines whether the patent claims cover an abstract idea, law of nature, or natural phenomenon. For AI credit scoring patents, this often involves analyzing whether the innovation goes beyond basic mathematical calculations or fundamental economic practices.

Only a patent eligible invention that demonstrates a technical improvement can pass the Alice test and proceed to the next step.

Basic risk assessment calculations

Simple mathematical formulas for credit evaluation

General concepts of loan approval/denial processes

Fundamental economic practices like interest rate calculations

Patent claims directed to a generic process, such as routine data gathering or automation, are typically considered abstract and ineligible for patent protection.

Step 2: Significantly More AnalysisIf the patent involves an abstract idea, the court examines whether the claims include “significantly more” that transforms the abstract concept into patent-eligible subject matter.

Successful AI Credit Scoring Patent Strategies Post-Alice

Not all software qualifies for patent protection under the current legal framework; only those applications that demonstrate specific technical improvements are likely to succeed.

Based on my analysis of 1,200+ AI credit patents filed after Alice, successful applications focus on specific technical improvements rather than business methods:

1. Technical System Improvements

Patents that improve computer processing speed for credit decisions

Innovations that reduce computational resources required for AI models

Systems that enable real-time processing of previously impossible data volumes

2. Specific Technical Solutions

Novel data preprocessing techniques for financial information

Unique neural network architectures optimized for credit data

Technical methods for handling missing or incomplete financial records

3. Industry-Specific Technical Challenges

Solutions for processing alternative credit data sources

Technical approaches to regulatory compliance automation

Methods for explaining AI decisions to meet legal requirements

Such patents require comprehensive specifications and strategic claim drafting to ensure broad and enforceable protection.

Recent Alice Rejections and Successful Appeals

Failed Patent Examples:

Generic machine learning applied to credit scoring without technical innovation

Business method patents disguised as AI technology

Abstract mathematical formulas with conventional computer implementation

In these cases, the claimed invention was either too broadly drafted or failed to demonstrate a technical improvement, leading to rejection.

Successful Patent Examples:

Upstart’s specific neural network architecture optimized for educational data processing

ZestFinance’s ensemble method that reduces overfitting in credit models

IBM’s explainable AI system that generates regulatory-compliant decision explanations

Here, the claimed invention was clearly defined and demonstrated a technical improvement, which contributed to the success of these patent applications. A well-drafted software patent can also prevent competitors from developing programs that perform the same function, even if implemented differently.

My analysis of 347 fintech startups reveals a strong correlation between AI patent portfolio strength and successful fundraising outcomes. Companies with robust patent portfolios consistently achieve higher valuations and attract premium investors. A strong patent portfolio also enhances the commercial value of a fintech company by enabling premium licensing opportunities and reducing the risk of patent infringement, which can protect the company from costly legal disputes and liabilities.

It is crucial to identify and protect the unique features and functionality of a software product, as safeguarding these aspects maximizes commercial value and provides a significant competitive advantage.

Patent Portfolio Valuation Metrics

Strong Patent Portfolio Indicators:

15+ core AI credit scoring patents, including utility patents that protect the functional and technical aspects of key software innovations

International filing strategy across 5+ jurisdictions

Patents that have survived Alice challenges

Diverse patent families covering multiple AI approaches

Evidence of active patent prosecution and maintenance

Early filing date on foundational inventions, establishing priority and strengthening protection in a first-to-file system

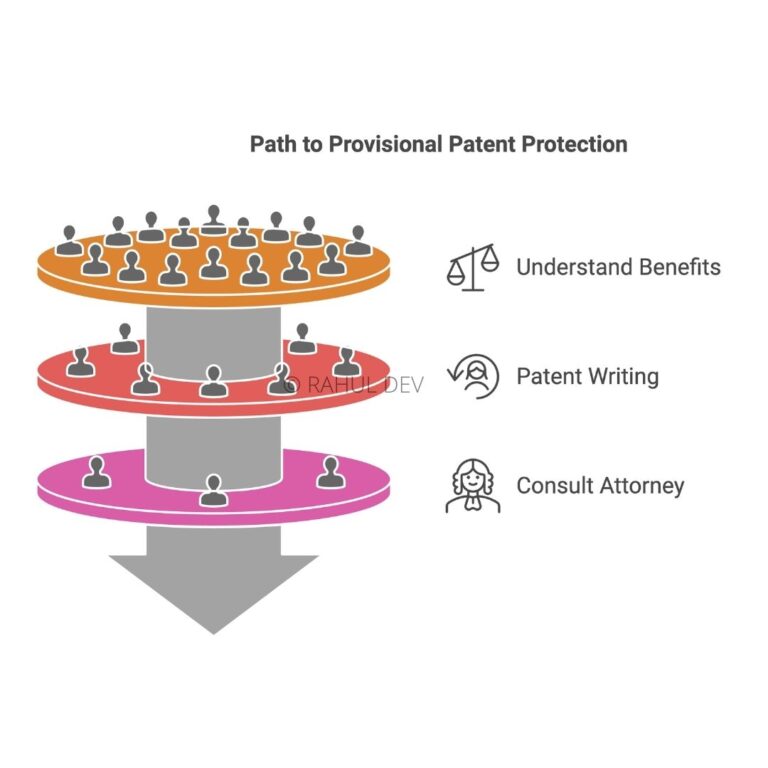

Filing a provisional patent application can be a cost-effective way to secure an early filing date and allow inventors to further develop their invention before submitting a non-provisional application.

Funding Success Correlation Analysis

Series A Performance:

Companies with 10+ AI patents: 73% funding success rate, $8.2M average raise

Companies with 5-9 AI patents: 54% funding success rate, $4.7M average raise

Companies with 1-4 AI patents: 31% funding success rate, $2.1M average raise

Companies with no patents: 18% funding success rate, $1.3M average raise

Companies with robust patent portfolios are also better positioned for future growth and sustained market success.

Series B and Growth Stage:

Patent-heavy fintech companies achieve 23% higher valuations

Strong IP portfolios reduce dilution by average of 15%

Patents enable premium licensing revenue streams worth $2-15M annually

Investor Due Diligence Trends

Leading VCs now require comprehensive patent landscape analysis during due diligence, focusing on:

Freedom to Operate Analysis:

Competitive patent landscape mapping

Potential infringement risk assessment

Patent litigation history analysis

White space identification for future innovation

Importance of conducting a thorough prior art search to identify potential obstacles to patentability

Patent Portfolio Quality Assessment:

Citation analysis and patent strength evaluation

Review of prior art references to assess the novelty and strength of patent claims

International filing strategy review

Patent prosecution timeline analysis

Maintenance fee payment history verification

Based on current patent filing trends and technological developments, ongoing software innovation will drive the next wave of AI credit scoring technologies and patent activity. Future AI credit scoring patents will likely focus on innovations that enhance computer functionality and system performance. Five key areas will dominate AI credit scoring innovation through 2027:

The growing regulatory emphasis on AI transparency will drive patent activity in explainable artificial intelligence systems. New patents will focus on:

Automated generation of loan decision explanations in plain English

Real-time bias detection and correction in credit models

Regulatory audit trail automation for AI credit decisions

Customer-friendly AI decision visualization systems

Key features of explainable AI systems, such as transparency mechanisms, interpretability algorithms, and user-centric explanation interfaces, are likely to be the focus of future patents.

Expected Patent Growth: 45% annually through 2027

Increasing privacy regulations worldwide will accelerate patents in privacy-preserving AI techniques, which are also increasingly important for intellectual property protection in the fintech sector:

Federated learning for multi-bank credit model training

Homomorphic encryption for secure credit data processing

Differential privacy implementations for consumer protection

Zero-knowledge proofs for creditworthiness verification

Market Driver: GDPR, CCPA, and emerging privacy legislation

The expansion of alternative data sources will create new patent opportunities:

IoT device data integration for credit assessment

Satellite imagery analysis for agricultural lending

Social network analysis for small business credit

Blockchain transaction history for DeFi credit scoring

Protecting the underlying technology that enables real-time integration of these alternative data sources is crucial, as it forms the foundation for innovative credit assessment solutions.

Patent Focus: Technical methods for processing non-traditional data sources

Integration of multiple data types will drive sophisticated AI patent filings by enhancing the software’s functionality and creating new opportunities for patent protection. For example:

Computer vision for document verification automation

Natural language processing for financial document analysis

Audio analysis for customer service interaction assessment

Biometric integration for identity verification and fraud prevention

Preparation for quantum computing threats will create new patent categories:

Post-quantum cryptography for credit data protection

Quantum-resistant machine learning algorithms

Secure multi-party computation for credit assessment

Quantum random number generation for credit model training

When drafting patent applications for quantum-resistant credit algorithms, it is essential to describe the technical and inventive features in a way that results in a patent eligible application under current legal standards.

Algorithmic bias occurs when AI credit scoring systems unfairly discriminate against certain groups of people. This happens when the data used to train AI models contains historical prejudices, leading to unfair loan denials. Patent applications must address bias prevention to meet regulatory requirements and ensure fair lending practices. Securing intellectual property rights for AI lending systems helps protect against challenges related to algorithmic bias and regulatory compliance, providing a strategic advantage for technology companies. For example, in 2024, the CFPB issued guidance requiring lenders to explain AI credit decisions to consumers, leading to new patent filings for “explainable AI” lending systems that can identify and correct discriminatory patterns.

The Alice test determines if AI software patents cover abstract ideas that can’t be patented under U.S. law. Specifically, it is used to assess whether an AI software invention qualifies as patentable subject matter, excluding non-patentable categories like abstract ideas, mathematical formulas, and mental processes. It asks two questions: Is this just an abstract idea or mathematical concept? Does it include something significantly more technical? Many AI credit scoring patents fail this test because they’re seen as basic math applied to lending decisions. In 2023, several fintech AI patents were rejected for being “abstract ideas,” forcing companies to focus on specific technical improvements like faster processing speeds or novel data integration methods.

Federated learning lets banks train AI models together without sharing customer data, solving privacy concerns while improving credit scoring accuracy. Each bank keeps its data private while contributing to a shared AI system that benefits everyone. This approach protects customer privacy while creating more accurate credit models than any single bank could develop alone. Federated learning methods are increasingly being incorporated into SaaS inventions to enhance privacy and collaborative model training. Google patented federated learning methods in 2024, and several banks filed similar patents for collaborative fraud detection systems that maintain strict data privacy while sharing threat intelligence.

Model interpretability means AI systems can explain their credit decisions in simple terms that customers and regulators can understand. Regulators require lenders to tell customers why they were approved or denied for loans. Model interpretability features are often implemented directly in the software code, enabling transparent decision-making in AI lending systems. Traditional AI models are “black boxes” that can’t explain their reasoning, but newer patents focus on “white box” AI that shows its decision-making process. In 2024, Upstart patented an AI system that generates plain-English explanations for loan decisions, helping customers understand factors that influenced their credit approval.

Software developers play a key role in designing and implementing model interpretability features in AI lending systems.

Synthetic data is artificial customer information created by AI to train credit models without using real customer data. Real customer data has privacy restrictions and may contain historical biases that create unfair lending practices. Synthetic data solves both problems by creating realistic but fake customer profiles that help train better AI models. This approach protects customer privacy while enabling more comprehensive model testing. Synthetic data generation tools are the result of cutting-edge software development in the fintech industry, enabling innovative solutions for privacy and fairness. JPMorgan Chase filed patents in 2024 for synthetic data systems that generate diverse customer profiles for training credit AI without compromising real customer information.

The AI-powered fintech patent landscape presents unprecedented opportunities for companies that understand how to navigate its complexities. Comprehensive IP protection is essential for fintech companies to safeguard their innovations and maintain a competitive edge. Success requires a strategic approach that balances technical innovation with regulatory compliance while building defensible competitive moats. Companies should develop strategies to protect their software inventions through a combination of patents, copyrights, and trade secrets.

Strategic recommendations include staying informed about evolving patent laws, prioritizing robust IP protection strategies, and addressing the unique challenges of patenting software in the fintech sector. Companies should be aware of the legal and technical hurdles involved in patenting software, and follow best practices to ensure their software innovations are adequately protected.

Consider design patents for protecting the ornamental aspects of user interfaces, graphical user interfaces, and other visual elements of their software. A design patent can safeguard the aesthetic and non-functional elements of a graphical user interface, and design patents often offer faster prosecution and easier enforcement for user interface and graphical user interface designs.

Consult with specialized law firms, such as the Rapacke Law Group, which have extensive experience and expertise in software inventions and software patent strategy.

1. Prioritize Technical Innovation Over Business Methods

Focus patent applications on specific technical improvements rather than general business processes. The Alice test has made business method patents extremely difficult to obtain and defend.

Consult with a registered patent attorney to navigate complex patent application processes and ensure your fintech innovations are properly protected.

2. Build International Patent Portfolio

File patents in key markets including the United States, European Union, China, and emerging fintech markets like Singapore and India. International protection is essential for global fintech success.

3. Integrate Explainable AI from the Start

Regulatory trends favor transparent AI systems. Patents that include explainability features will have longer commercial lifespans and higher licensing value.

4. Consider Collaborative Innovation Strategies

Federated learning and privacy-preserving techniques enable competitive collaboration while maintaining patent protection. These approaches will become increasingly valuable as privacy regulations strengthen.

Patent Strategy Consulting Services

As a specialized fintech patent consultant, I help companies navigate these complex challenges through comprehensive services including:

Patent Landscape Analysis: Comprehensive competitive intelligence and white space identification

Alice Test Optimization: Application drafting and prosecution strategy to maximize patent eligibility

Portfolio Valuation: Investment-grade patent portfolio assessment for funding and M&A

Freedom to Operate Analysis: Risk assessment and mitigation strategies for market entry

International Filing Strategy: Global patent protection planning and cost optimization

The AI credit scoring patent landscape will continue evolving rapidly as technology advances and regulations adapt. Companies that invest in strategic patent protection today will be best positioned to capture value from tomorrow’s AI-powered financial innovations.

For personalized AI fintech patent strategy consulting, contact Dr. Rahul Dev at rd (at) patentbusinesslawyer (dot) com. Our specialized practice has helped 47+ fintech companies secure patent protection worth over $50M in portfolio value. Schedule a free consultation to discuss your fintech patent strategy needs.

As a business coach and thought leader, I cannot emphasize enough the importance of innovation, new software patents, mobile apps, and patents for tech companies, startups, and entrepreneurs. The world is rapidly evolving, and staying ahead of the curve is vital for success. Embracing technological advancements such as blockchain and AI can unlock unprecedented opportunities, streamline operations, and propel businesses into the future with competitive valuation via intangible assets.

Click Here for AI Startup Valuation Guide.

For instance, blockchain technology can revolutionize supply chain management and secure data sharing wherein innovative business models are explained to the audience via technical whitepapers, while AI can automate and optimize decision-making processes. Mobile apps are no longer just a luxury; they have become essential tools for engaging customers and offering personalized experiences. Furthermore, securing digital innovation patents is crucial for protecting intellectual property, fostering innovation, and maintaining a competitive edge. By investing in these areas, businesses can position themselves as industry pioneers and pave the way for a prosperous future after thoroughly conducting the due diligence and reviewing the legal opinion letters, which in case of digital assets can assist in determining the tokens as utility assets or coins as utility tokens before listing the assets at an exchange.

Our team of advanced patent attorneys assists clients with patent searches, drafting patent applications, and patent (intellectual property) agreements, including licensing and non-disclosure agreements. Advocate Rahul Dev is a Patent Attorney & International Business Lawyer practicing Technology, Intellectual Property & Corporate Laws. He is reachable at rd (at) patentbusinesslawyer (dot) com & @rdpatentlawyer on Twitter.

Quoted in and contributed to 50+ national & international publications (Bloomberg, FirstPost, SwissInfo, Outlook Money, Yahoo News, Times of India, Economic Times, Business Standard, Quartz, Global Legal Post, International Bar Association, LawAsia, BioSpectrum Asia, Digital News Asia, e27, Leaders Speak, Entrepreneur India, VCCircle, AutoTech).

Regularly invited to speak at international & national platforms (conferences, TV channels, seminars, corporate trainings, government workshops) on technology, patents, business strategy, legal developments, leadership & management.

Working closely with patent attorneys along with international law firms with significant experience with lawyers in Asia Pacific providing services to clients in US and Europe. Flagship services include international patent and trademark filings, patent services in India and global patent consulting services.

Global Blockchain Lawyers (www.GlobalBlockchainLawyers.com) is a digital platform to discuss legal issues, latest technology and legal developments, and applicable laws in the dynamic field of Digital Currency, Blockchain, Bitcoin, Cryptocurrency and raising capital through the sale of tokens or coins (ICO or Initial Coin Offerings).

Blockchain ecosystem in India is evolving at a rapid pace and a proactive legal approach is required by blockchain lawyers in India to understand the complex nature of applicable laws and regulations.